Top 10 Suggestions On How To Evaluate The Quality Of Data And Its Sources For Ai-Powered Stock Analysis/Predicting Trading Platforms

Examining the quality of the data and sources utilized by AI-driven stock predictions and trading platforms is critical to ensure reliable and accurate insights. Inaccurate data can lead to inaccurate predictions, financial losses, or even a lack of trust towards the platform. These are the top 10 tips for assessing the quality of data as well as sources:

1. Verify source of data

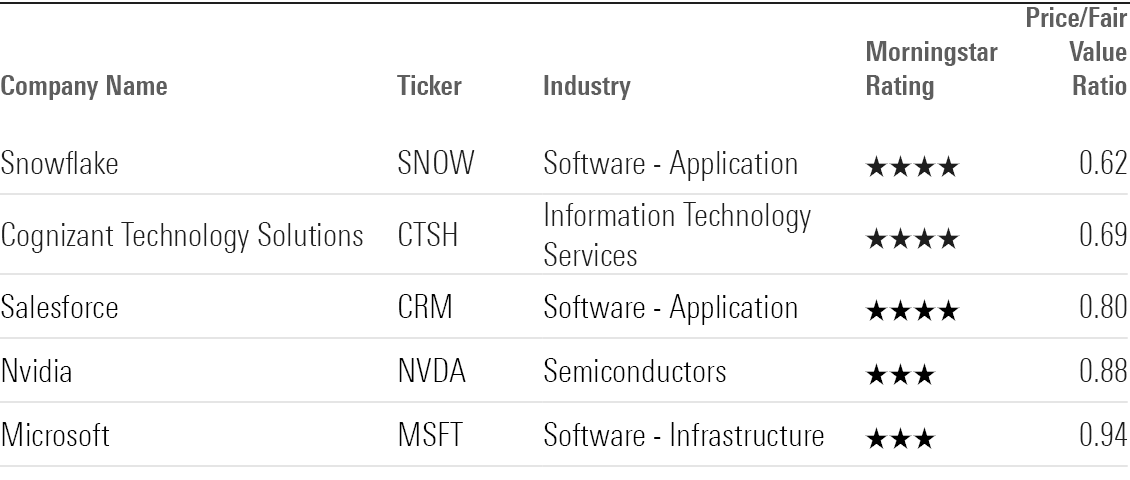

Verify the source of the data. Ensure that the platform is based on well-known, reputable data sources (e.g. Bloomberg Reuters Morningstar, or stock exchanges such NYSE, NASDAQ).

Transparency. Platforms must disclose their data sources and be updated regularly.

Avoid relying on a single platform: trustworthy platforms often combine data from several sources to lessen the chance of bias.

2. Examine the quality of data

Real-time data vs. delayed data: Decide whether the platform is providing actual-time data, or delayed data. Real-time data is crucial to ensure that trading is active. However, data that is delayed may be sufficient for long-term analytics.

Be sure to check the frequency of updates (e.g. minute-by-minute updates and hourly updates, or daily updates).

The accuracy of data from the past: Check to ensure that data is consistent and free of irregularities or gaps.

3. Evaluate Data Completeness

Look for missing data.

Coverage: Ensure that the trading platform is able to support an extensive range of the indices and stocks relevant to your plan.

Corporate actions: Make sure that the platform is inclusive of stock splits (dividends), mergers, and other corporate actions.

4. Test Data Accuracy

Cross-verify data: Compare data from the platform to other sources of data you trust to guarantee that the data is consistent.

Search for errors through examining excessive financial data or outliers.

Backtesting: You may use old data to evaluate trading strategies. Examine if they meet your expectations.

5. Granularity of data may be evaluated

The level of detail you are looking for - Make sure you can get granular details such as intraday volumes as well as prices, bid/ask spreads, and the order book.

Financial metrics: See if the platform has complete financial statements (income statement and balance sheet, as well as cash flow) and important ratios (P/E, P/B, ROE, etc. ).

6. Verify that the Data is Clean and Preprocessing

Data normalization: Ensure the platform normalizes the data (e.g. and adjusting for splits, dividends) to ensure consistency.

Outlier handling: Check how the platform handles outliers and anomalies.

Data imputation is missing - Verify whether the platform is using reliable methods to fill out missing data points.

7. Examine the consistency of data

Align all data with the same timezone. This will avoid discrepancies.

Format consistency: Ensure your data is presented in a consistent manner.

Cross-market consistency: Verify data alignment across markets or exchanges.

8. Assess Data Relevance

Relevance to your strategy for trading The data you're using is in accordance with the style you prefer to use in trading (e.g. technical analysis or qualitative modeling or fundamental analysis).

Selecting features: Make sure whether the platform provides relevant features to enhance the accuracy of your predictions (e.g. sentiment analysis, macroeconomic indicator, news data).

Review Data Security Integrity

Data encryption: Ensure that the platform uses encryption for data transmission and storage.

Tamper-proofing : Make sure that the data has not been altered by the platform.

Compliance: Verify that the platform is compliant with any laws governing data protection (e.g. GDPR or the CCPA).

10. Transparency of the AI Model of the Platform is Tested

Explainability: Make sure the platform gives insight on the way in which the AI model uses the data to make predictions.

Bias detection: Verify that the platform monitors, and mitigates, biases within the models or data.

Performance metrics: Determine the reliability of the platform by looking at its track record, performance metrics, and recall metrics (e.g. precision and accuracy).

Bonus Tips

User feedback and reputation Review user reviews and feedback to determine the reliability of the platform.

Trial period. Try the trial for free to test the features and data quality of your platform prior to deciding to decide to purchase.

Support for customers - Ensure that the platform is able to provide a solid customer service to solve any data-related issues.

With these suggestions to help you better evaluate the quality of data and sources of AI platform for stock predictions, ensuring you make well-informed and trustworthy trading decisions. Have a look at the top rated helpful hints about chart ai trading assistant for blog info including ai for investment, options ai, ai trading tools, best ai trading software, incite, ai stock picker, options ai, market ai, chart ai trading assistant, investment ai and more.

Top 10 Tips For Evaluating The Trial And Flexibility Of Ai Platforms For Predicting And Analysing Stocks

In order to ensure the AI-driven stock trading and forecasting platforms meet your expectations It is important to evaluate their trial and flexible options prior to committing to a long-term contract. Here are the top 10 tips for evaluating each aspect:

1. You can get a free trial.

Tip: See the trial period to test the features and performance of the system.

You can evaluate the platform at no cost.

2. Trial Duration and Limitations

Check the length of the trial, and any restrictions.

The reason: Once you understand the trial constraints, you can determine whether it's a complete assessment.

3. No-Credit-Card Trials

TIP: Find trials that don't require credit card information upfront.

The reason: This lowers the chance of unanticipated charges and makes it easier to decide whether or not you want to.

4. Flexible Subscription Plans

Tips: Make sure there are clear pricing tiers and flexible subscription plans.

The reason: Flexible plans permit you to tailor your commitment according to your needs and budget.

5. Customizable Features

Check the platform to see whether it lets you customize certain features like alerts, trading strategies, or risk levels.

Customization allows you to tailor the platform to meet your desires and trading goals.

6. Easy cancellation

Tip - Check out how easy it is for you to downgrade or cancel a subscription.

What's the reason? If you can cancel without any hassle, you'll be able to stay out of the wrong plan for you.

7. Money-Back Guarantee

Tips: Search for websites that provide a money-back guarantee within a specific period.

Why: It provides security in the event the platform doesn't meet your expectations.

8. Trial Users Gain Full Access to Features

Be sure to check that you can access all the features in the trial version, not just a limited edition.

The reason: You can make an an informed choice by testing all the features.

9. Customer Support during Trial

Tips: Assess the level of customer service provided throughout the trial time.

You'll be able make the most of your trial experience when you are able to count on reliable support.

10. After-Trial Feedback Mechanism

Tips: Find out whether the platform solicits feedback following the trial in order to improve its services.

Why is that a platform that is based on the feedback of users is more likely evolve and be able to meet the needs of users.

Bonus Tip Optional Scalability

If your business grows your trading, the platform must have more advanced options or plans.

If you take your time evaluating the options for trial and flexibility and flexibility options, you will be able to decide for yourself whether you think an AI trade prediction and stock trading platform is a good fit for your needs before making a financial commitment. See the best my sources for stocks ai for blog recommendations including ai for trading stocks, ai investment tools, ai stock predictions, ai copyright signals, chart ai trading, trading ai tool, best stock prediction website, ai trading tool, can ai predict stock market, ai investment tools and more.

Comments on “20 Handy Reasons For Picking AI Stock Predictions Analysis Websites”